Yesterday we spoke of bullish asset inflows in a prominent ?Low Vol? equity product, USMV (iShares MSCI USA Minimum Volatility, Expense Ratio 0.15%) and the potential that investors looking for above market average yields are seeking out such ETF products given the market environment.

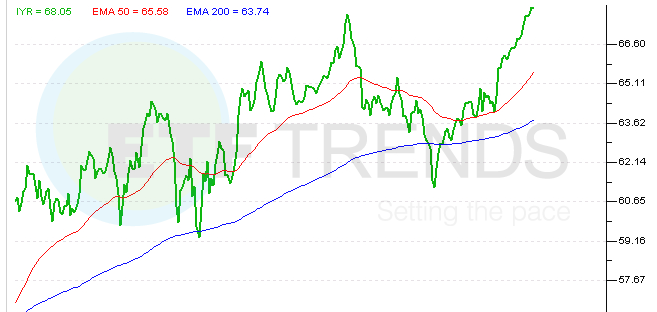

Pursuing this same angle today, the U.S. REIT space has caught our attention because it too has attracted strong asset inflows in recent trading sessions via the two largest products in the subsector, VNQ (Vanguard REIT, Expense Ratio 0.10%) and IYR (iShares U.S. Real Estate, Expense Ratio 0.48%) in terms of assets under management.

IYR has reeled in approximately $140 million in the last few sessions while VNQ has pulled in nearly $200 million during the same time frame, and it is noteworthy that these ETFs are also continually, session after session it seems as of late, trading at new multi-year highs while trading volume in the sector has been above average. [REIT ETFs: A Word of Caution]

With the yield of the S&P 500 coming in at around 2.18% currently, some would argue that REITs have not lost their appeal even given the broad market run up because their yields are more than competitive on the whole (VNQ 3.56%, IYR

3.70%) compared to the benchmark index, and price performance in terms of relative strength in the underlying REIT equities has been promising for the past several quarters as well.

IYR tracks the Dow Jones U.S. Real Estate Index, with current top holdings appearing as follows: SPG 9.11%, AMT 5.69%, PSA 3.89%, VTR 3.56%, and EQR 3.40%.

Meanwhile, VNQ tracks the MSCI U.S. REIT Index, and its top holdings round out accordingly: SPG 10.78%, PSA 4.75%, HCP 4.37%, VTR 4.29%, and EQR 4.05%.

One can see there is clear overlap in terms of names in common here between the two funds, and it really comes down to which specific exposure the portfolio manager desires in terms of exposure to small/mid/large cap equity names as well as particular exposure to specific REIT segments (commercial, residential, storage, etc.).

iShares U.S. Real Estate

?

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.

Source: http://www.etftrends.com/2013/01/dividend-investors-pouring-money-into-real-estate-etfs/

bobby brown suzanne somers colbert colbert report legionnaires disease underwear bomber unclaimed money

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.